Are You Taking Advantage of

Government Stimulus Programs

SBA Stimulus Benefits Expire September 30th -

Understand the Program and See if You Qualify Before it's too Late

Even though the program expires on 9/30, realistically you need to start the conversation today to beat the deadline.

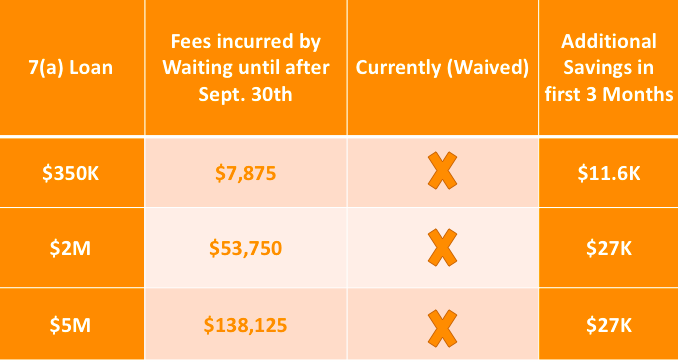

HERE IS A SNAP SHOT OF YOUR POTENTIAL SAVINGS

SBA loans can go up to $5MM for working capital, acquisitions, partner buyouts, real estate and debt restructuring.

As most of the government programs are winding down, PPP, EIDL, etc., we want to be sure you don’t miss out on the unbelievable savings being offered on SBA’s flagship 7(a) loan program. These incentives are available until September 30, when normal charges will return.

DO YOU QUALIFY?

MEET OUR CEO & PRESIDENT

Your SBA Loan Experts

Ami Kassar, founder and CEO of MultiFunding and author of The Growth Dilemma, has earned a national reputation as a thought leader in business finance.

An in-demand speaker and trusted advisor to growth-focused business leaders, Ami has helped thousands of business owners achieve ambitious growth goals through creative and personalized funding solutions. His work has helped create tens of thousands of jobs.

For more than 20 years, Ami has challenged executives to think differently about how they capitalize growth. Regularly featured in national media including The New York Times, Huffington Post, The Wall Street Journal, Entrepreneur, Forbes and Fox Business News, Ami also writes a weekly column for Inc. Magazine. He has advised the White House, the Federal Reserve Bank and the Treasury Department on credit markets.

Ami regularly speaks at corporate, academic and industry events on topics including entrepreneurship and access to capital.

Lynn Ozer, President of MultiFunding, is a strategic and highly accomplished financial executive with vast expertise in small business lending departments, training existing and aspiring lenders on SBA’s loan origination policies and procedures, and advocating on local and national level for policies that prioritize small business.

She has established capabilities in sales, credit, portfolio management, liquidation, and operations. She leverages outstanding leadership and communication skills to present opportunities to executive teams and cultivates relationships with key business partners. Lynn is a driven and focused top-performer who drives the ownership of business results, capitalizes on lucrative new opportunities, and consistently exceeds goals.

As the first woman to chair the board of the National Association of Government Guaranteed Lenders (NAGGL), Lynn continues to instruct lenders for NAGGL and actively participates by serving on the government relations, technical issues and executive committees. In doing so, she has remained involved at a national level advocating for small businesses and monitoring the issues and trends in the industry.

©2021. All rights reserved

www.multifunding.com | 800-276-0690 | [email protected]